Five Takeaways From Harley-Davidson's Q1 2023 Results

Looking beyond the numbers

Harley-Davidson reported its 2023 Q1 numbers today, and the financial results were generally positive, with significant increases in motorcycle shipments, revenue, net income and earnings per share compared to the same quarter of 2022. The news wasn’t all rosy however, as retail sales were down, and LiveWire has yet to find its footing since branching into a separate brand.

There was a lot to unpack from Harley-Davidson’s Q1 presentation, but first let’s take a look at the raw numbers.

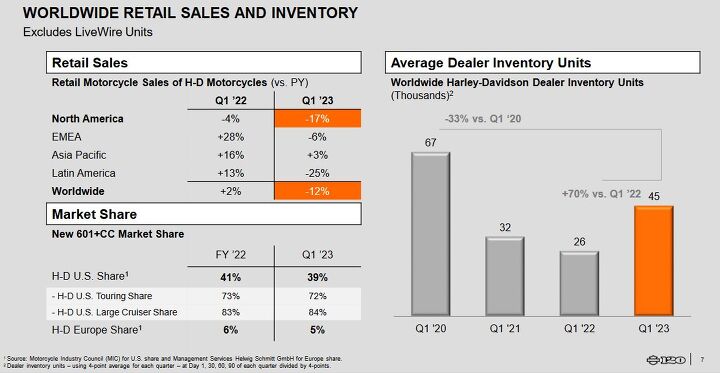

Harley-Davidson reported $1.56 billion in revenue over the first quarter, up 21% from 2022. Retail sales were down 12%, with approximately 39,400 motorcycles sold compared to about 45,000 last year, and North American sales seeing a 17% drop. Despite the decrease in unit sales, Harley-Davidson still generated $1.3 billion from motorcycle sales, compared to $1.06 billion last year.

Overall, Harley-Davidson Inc. reported $1.79 billion in revenue (up 20% from 2022), and an operating income of $370 million (up 28%). Total net income rose 37% to $304 million from the $223 million reported in the first quarter last year.

Delving deeper into the numbers, and listening to comments from the company’s executives such as President and Chief Executive Officer Jochen Zeitz, here are five important takeaways from Harley-Davidson’s Q1 presentation.

Sales are Down, but Shipments are Up

As mentioned above, Harley-Davidson saw a 12% decrease in motorcycle sales, with about 39,400 bikes sold. Despite the drop in retail sales, Harley-Davidson reported an increase in motorcycle shipments, delivering about 62,237 bikes in the quarter, versus approximately 54,746 shipments in Q1 2022.

That means we’re seeing more inventory arriving in dealerships, with average inventory up 70% compared to the same quarter last year. More significantly, this means dealer inventory over the first quarter is at its highest level since COVID. Inventory is still well off the 67,000 units in Q1 2020, but it’s a healthier level than the 32,000 and 26,000 units seen in the last two first quarters.

Edel O’Sullivan, Harley-Davidson chief commercial officer, says current inventory is at a “healthy” level, compared to the down numbers of 2021 and 2022, but below what the company considers to be “damaging levels of inventory” seen in 2019 and 2020. Whether this is indeed healthy or not will be determined by how retail sales fare in Q2 as we enter the riding season.

How Product Mix Factors into the Sales Results

While there is more inventory in dealerships than there was this time last year, it’s important to note the type of Harleys this includes.

This is the first year that Harley-Davidson has stopped producing EVO Sportsters, which were the least expensive models in its lineup. That means that the motorcycles sitting in showrooms are not only in higher volume than last year, they also carry much higher MSRPs.

On the other end of the price spectrum, Harley-Davidson only had one Custom Vehicle Operations model available in the quarter, the CVO Road Glide Limited Anniversary Edition. The company waited until this week to announce the 2023 CVO Road Glide and CVO Street Glide, and they won’t be available for purchase until the summer. Though we don’t know their MSRPs yet, it’s safe to assume they will be on the higher end of Harley’s offerings.

“We retired the EVO Sports in North America, a model that was cherished over the last 65 years, but has been carrying negative margins for the Motor Company for many years,” says Zeitz. “It is important to note that the phaseout of Sportster and the cadence of CVO model rollout throughout the year has created a different retail unit volume dynamic in '23 versus prior years. And while RevMAX will be able to compensate in part for the EVO Sportster, we need to consider the different price and overall positioning.”

Lightweight Models for Asian Markets

This year saw the introduction of two models produced in China, and a teaser for a third produced in India.

The Harley-Davidson X 350 debuted in March, and the X 500 (pictured above) was introduced earlier this month. Both X models are produced by Harley-Davidson’s partner, QJ Motors, and intended mainly for the Chinese market, though an X350RA variant is being imported to the U.S. for Harley-Davidson’s Riding Academy. It’s still early, but Zeitz says the company is encouraged by their reception.

The X models appear for the first time as line items in Harley-Davidson’s financial filings, with the company reporting shipments of 1,041 X 350 and X350RA units (the X 500’s launch counts towards the second quarter). To put this in perspective, Harley-Davidson shipped 2,175 Pan Americas during the quarter, with models arriving at showrooms just after New Years, while the X shipments all occurred in the final three weeks of the quarter.

The lightweight portfolio will expand again later this year when the first product of Harley-Davidson’s partnership with Hero Motocorp debuts in India.

LiveWire’s Tepid Sales

This is the start of the first full fiscal year for LiveWire since it separated into its own brand. Over the first quarter, 63 LiveWire One models were shipped out, compared to 72 LW1s last year. If you include 25 Harley-Davidson-branded LiveWire models also sold in Q1 2022, unit sales are down 36%. Of course, at these volumes, percentage changes don’t mean as much; the volume figures are low regardless.

Making matters worse, sales for STACYC balance bikes were also down 22% in the quarter, with LiveWire taking a more conservative approach to inventory. Overall, LiveWire reported a net loss of $21.1 million compared to a loss of $16.0 million in the same quarter last year.

While sales remain low, the bigger contributor to the net loss remains the added startup costs of establishing a separate brand, plus an increase in product development investments, two factors that aren’t expected to pay off until much farther down the road.

There is some positive news for LiveWire on the horizon. LiveWire expanded into Europe on March 15, establishing operations in Germany, France, the Netherlands, and the United Kingdom. European LiveWire One sales are expected to begin in mid-May, which should help improve the numbers in Q2.

We’re also waiting for the S2 Del Mar to start shipping. LiveWire’s second motorcycle got pushed back, with deliveries expected to begin in Q3. Priced at $15,499, or about two-thirds the price of the LiveWire One, LiveWire is positioning the S2 Del Mar to be a higher-volume seller than its predecessor.

Icon and Enthusiast Collection Models Coming Next Week

We still have to wait until June 7 for the next-generation CVO models to launch, but Harley-Davidson has another product launch coming much sooner. Zeitz announced that Harley-Davidson will launch new additions to its Icons and Enthusiast collections next week.

The Enthusiast collection consists of limited edition models recognizing subsets of Harley-Davidson fans. In 2022, Harley-Davidson offered a G.I. Enthusiast collection, with a Pan America 1250 Special and Tri Glide Ultra in a military-inspired Mineral Green Denim Deluxe styling. We expect the 2023 Enthusiast collection will go in a different direction; with this being the company’s 120th anniversary, we suspect the collection will honor a piece of Harley-Davidson’s history.

As we previously reported, we expect this year’s Icon model to be a bike called the FLHFB Electra Glide Highway King. Based on its name, we expect the FLHFB to be based on a similarly-lettered model Electra Glide variant offered in the ’60s. We suspect it will have a windshield instead of a fairing, and serve as a spiritual successor to the now-discontinued FLHR Road King.

Become a Motorcycle.com insider. Get the latest motorcycle news first by subscribing to our newsletter here.

Dennis has been a part of the Motorcycle.com team since 2008, and through his tenure, has developed a firm grasp of industry trends, and a solid sense of what's to come. A bloodhound when it comes to tracking information on new motorcycles, if there's a new model on the horizon, you'll probably hear about it from him first.

More by Dennis Chung

Comments

Join the conversation

Typical HD financials: Sales are way down. Revenue is way up. Record executive bonuses and stock options are on the way!